Réunion Aérienne & Spatiale wishes you a 2026 marked by human progress

Wishing You a Prosperous Lunar Year of the Snake! As We Welcome the Year of the Snake, La Réunion Aérienne wishes a Happy Lunar New Year to All its Chinese…

Voir l'article

Wishing You a Prosperous Lunar Year of the Snake!

As We Welcome the Year of the Snake, La Réunion Aérienne wishes a Happy Lunar New Year to All its Chinese partners and clients around the world.

The Year of the Snake symbolizes wisdom, transformation, and resilience; values that align perfectly with the spirit of aviation industry.

Here’s to a year filled with success, collaboration, and soaring achievements.

Happy Lunar New Year!

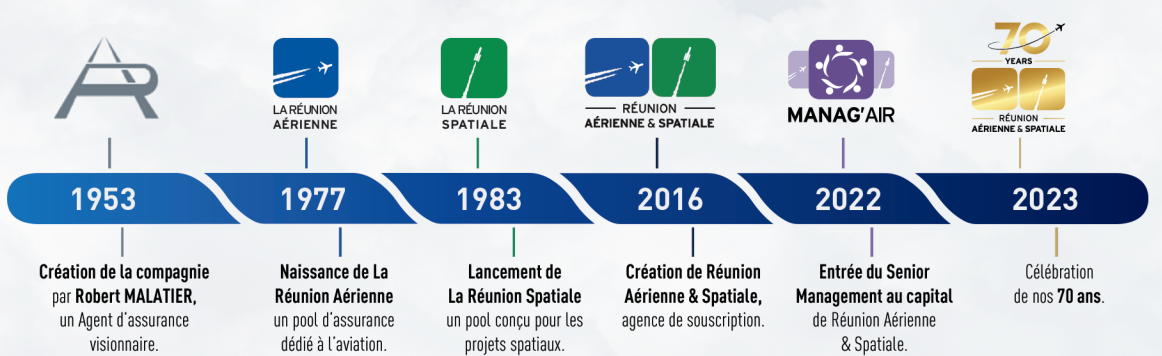

Sept décennies, enfin, d’une formidable aventure humaine aux côtés de celles et ceux qui portent et incarnent notre projet. Aujourd’hui comme demain, vous trouverez à votre écoute l’équipe de Réunion Aérienne & Spatiale qui se porte garante de l’excellence de notre offre de services : à Paris comme à Londres, des hommes et des femmes de tous profils, forts de leurs compétences et de leur diversité, accompagnent au quotidien nos clients avec une réactivité sans faille, un engagement jamais démenti et une expertise métier sans cesse renouvelée.

Cette formidable synthèse constitue à tous égards notre plus belle réussite et notre plus bel actif. Elle pose en outre des fondations solides sur lesquelles s’ouvre plus sereinement que jamais le prochain chapitre de notre aventure commune : cap sur le centenaire !

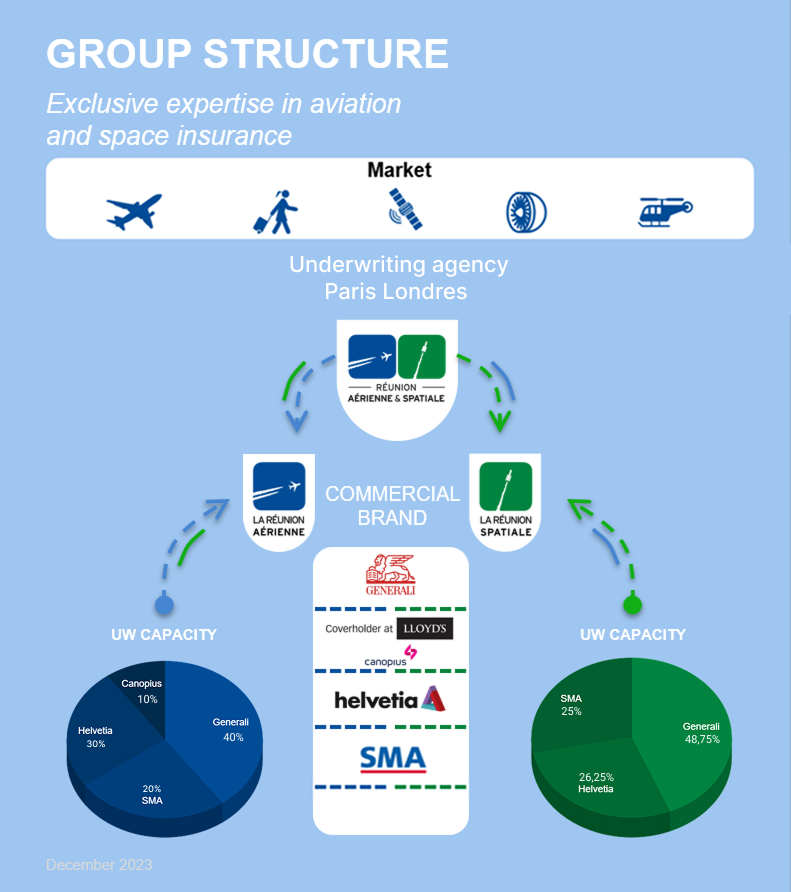

Nous développons notre activité avec l'appui fidèle de grands groupes d'assurance européens et chinois, d’une solidité financière de premier plan. Cette relation de proximité nous permet d’offrir à nos clients et intermédiaires, agents et courtiers, un niveau de sécurité financière unique sur le marché.

SuiteRÉUNION AÉRIENNE & SPATIALE souscrit des affaires pour le compte de ses compagnies mandantes, dans la plupart des pays et territoires, sous réserve des lois et réglementations locales et des éventuelles sanctions internationales.

Suite

RÉUNION AÉRIENNE & SPATIALE, convaincue de la nécessité d’intensifier la lutte contre le réchauffement climatique, s’engage dans une démarche d’écoresponsabilité. Pour ce faire, elle poursuit une stratégie de réduction de ses émissions de gaz à effet de serre tout en sponsorisant un projet innovant de reforestation, en partenariat avec la plateforme spécialisée ![]() .

.